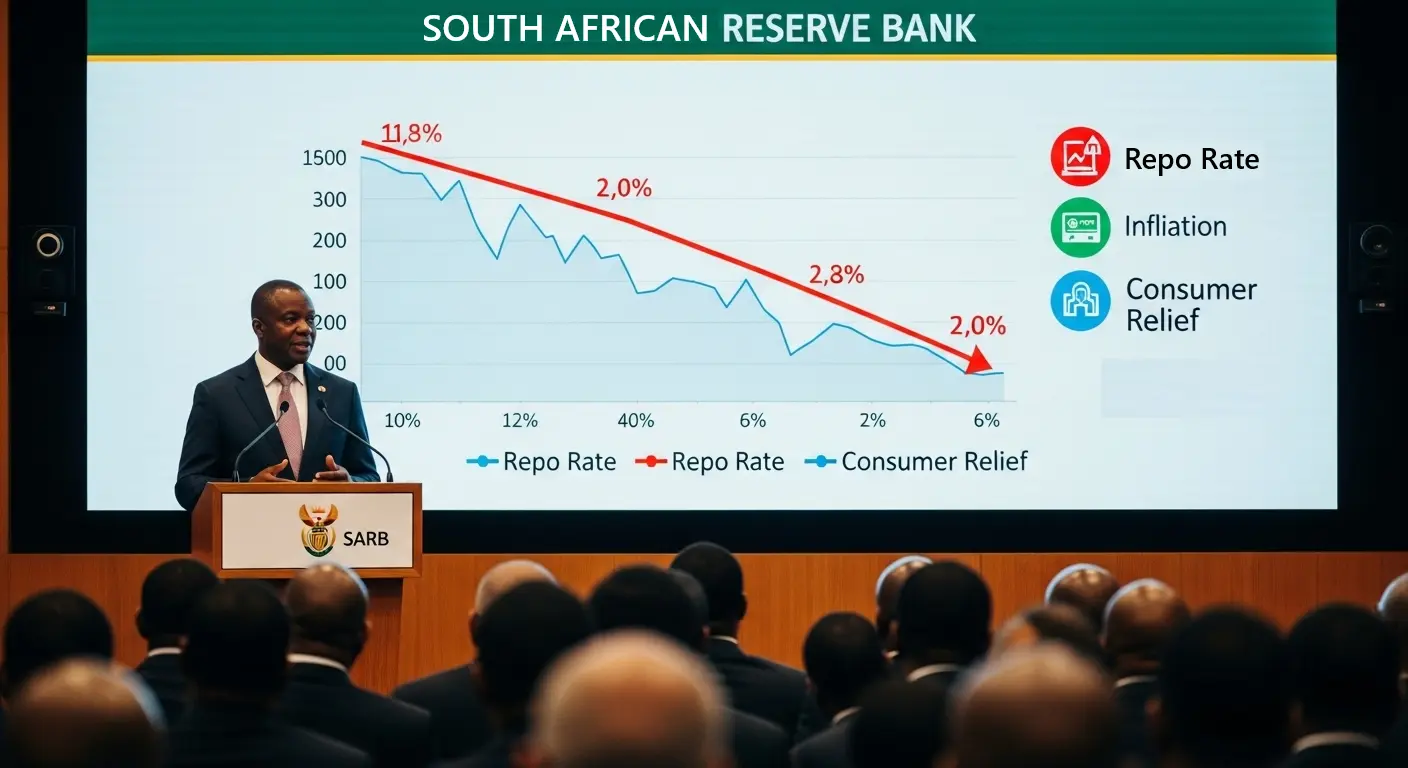

South Africans will get a slight reprieve from rising costs as the South African Reserve Bank (SARB) has officially cut the repo rate by 25 basis points, bringing it down to 7.25%, while the prime lending rate now sits at 10.75%.

This marks the first interest rate cut in some time, offering a sigh of relief to households and businesses struggling with debt repayments and the high cost of living.

Decision Details: Not Unanimous, But Clear

The decision was reached during the SARB’s Monetary Policy Committee (MPC) meeting, where five members voted in favour of the 25-point reduction. Interestingly, one member pushed for an even bigger 50-point cut—a sign that the economic slowdown may be worse than expected.

Unlike previous meetings, none of the MPC members voted to keep rates unchanged.

Why the Cut? Global & Local Pressures to Blame

SARB Governor Lesetja Kganyago explained that global economic conditions have worsened since the committee’s last meeting.

“Higher tariffs on US imports and rising uncertainty have hurt global growth,” Kganyago said.

The Reserve Bank also lowered its global growth projections as a result of escalating trade tensions, particularly involving the United States. Safe-haven assets like gold and the euro have outperformed, signaling caution among global investors.

Local Economy Struggles to Gain Momentum

On the home front, South Africa’s economy continues to lag. Kganyago highlighted that:

- No official GDP data has been released for Q1 2025, but mining and manufacturing remain underwhelming.

- Unemployment has risen further.

- SARB’s GDP growth forecast has been cut to 1.2% in 2025 and 1.8% in 2026.

Inflation has remained below the SARB target range, largely thanks to declining fuel prices. Additionally, the absence of a VAT hike—previously considered a risk—has helped keep inflation expectations low.

Lower Rates Ahead? SARB Eyes a 3% Inflation Target

In a major revelation, Kganyago said the SARB is now exploring a tighter inflation target—potentially reducing it to 3%, down from the current midpoint of 4.5%.

“Now that inflation has slowed, we have a chance to lock in lower inflation at low cost,” he said.

Analysts have long speculated that SARB would eventually adopt a stricter target to better align with international norms. The bank’s Quarterly Projection Model shows that under the 3% scenario, the repo rate could fall below 6%—a significant shift from today’s levels.

How Will a 3% Inflation Target Impact the Economy?

According to Kganyago:

- Interest rates would drop more steadily over time.

- Inflation expectations would stabilize around 3% by 2026.

- The economy might grow more slowly at first, but gain stronger momentum in the long run due to lower rates and increased consumer spending.

What This Means for You

With the repo rate at 7.25%, South Africans can expect:

✅ Slightly lower loan repayments (home, car, and personal loans)

✅ Better affordability for borrowing

✅ Improved confidence in the economy

✅ A possible boost in consumer spending

However, the MPC made it clear that rate decisions remain data-driven, so consumers should still manage their finances cautiously.

What Happens Next?

The Reserve Bank will continue to assess the viability of a 3% inflation target at upcoming meetings, which could lead to further cuts in interest rates if inflation remains low.

Kganyago concluded:

“We would like to see inflation expectations move lower. The 3% objective is an attractive scenario.”